You can download the “Islamic Finance and the Development of Malaysia’s Halal Economy” by World Bank Group here.

World Bank Group, sponsored by Bank Negara Malaysia and Securities Commission Malaysia, has recently published a report titled “Islamic Finance and the Development of Malaysia’s Halal Economy” to highlight the current state of the Halal Economy in Malaysia.

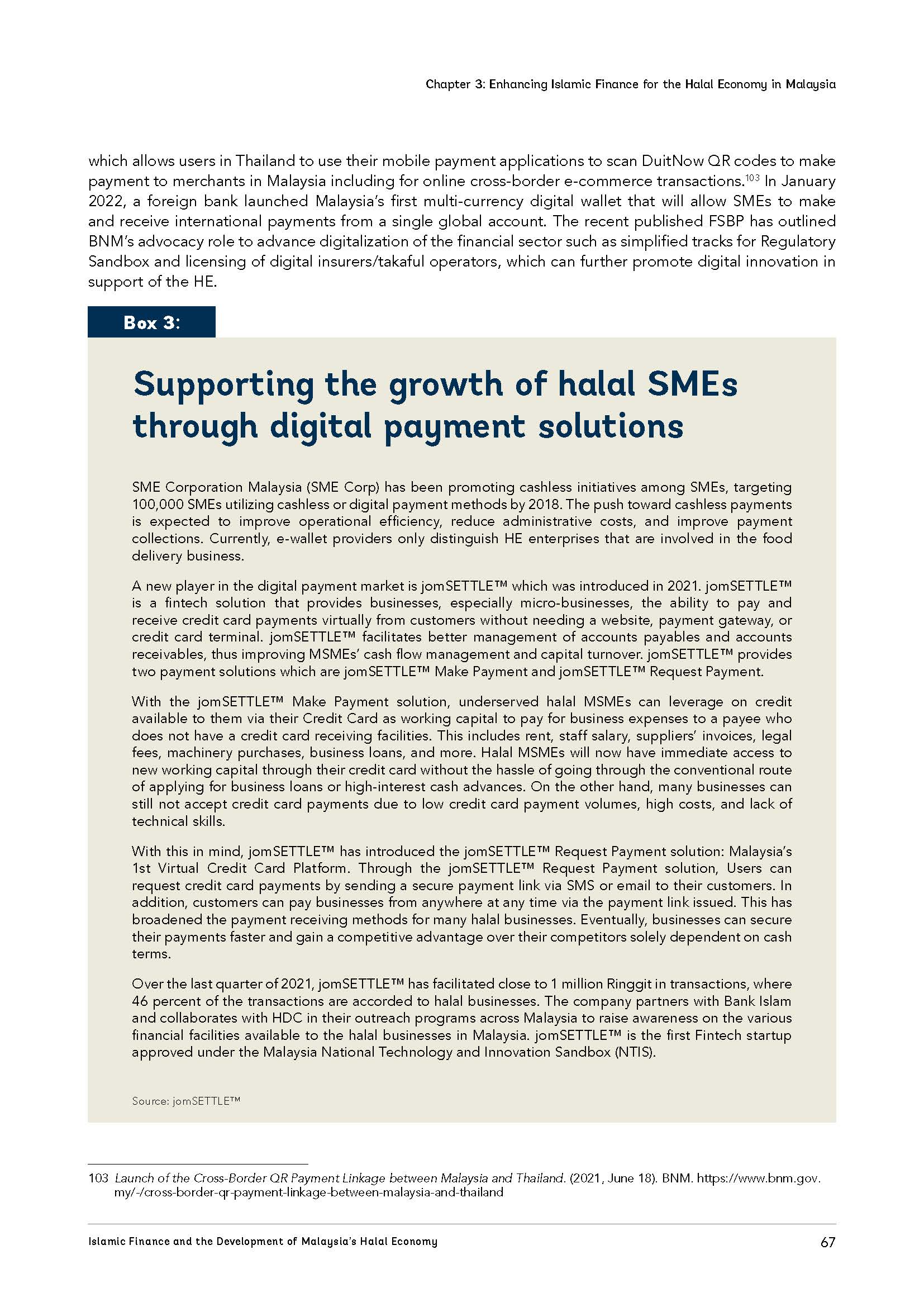

jomSETTLE are honored to be featured as one of the case studies for Fintech Digital Payment solution that are empowering the Halal MSMEs in Malaysia in managing their account payable and receivable via credit card.

It was a fine Monday morning (3rd October 2022) at Sasana Kijang Building, Bank Negara Malaysia in Kuala Lumpur where the launching event is being held. Aside from launching, the event was also to discuss strategies for boosting Malaysia’s economic growth through the competitiveness of the halal industry, which has a significant share of the global halal market.

Some of the images during the event.

The section about jomSETTLE in the Islamic Finance and the Development of Malaysia’s Halal Economy report, page 67.

About World Bank

The World Bank Group is a major source of funding and knowledge for developing countries around the world. Its five institutions are all dedicated to reducing poverty, increasing shared prosperity, and promoting long-term development.

More info: World Bank

Partnership to empower Malaysia Halal MSMEs

Since last year, we have worked closely with our partner Halal Integrated Platform (HIP) and Halal Development Corporation (HDC) to offer a better payment solution for the MSMEs.

Through jomSETTLE Make Payment, MSMEs can fund their business using their credit card by paying for any business expenses while conversing the cash in hand. This allows MSMEs to get short-term financing access via their credit card.

Alternatively, MSMEs can also use jomSETTLE Request Payment to allow their customers to pay them using credit card through a secured payment link. All are done in jomSETTLE cloud platform without the need of a credit card terminal, payment gateway, or website.

Our journey so far... and further we will go

To date, we have facilitated more than RM3 Million in business transactions for the Halal MSMEs through our platform in account payable and account receivables. (This number was based on jomSETTLE internal update on 30th September 2022. So, the number is different from the World Bank’s report)

With this, our team will continue to work toward a better payment solution for the MSMEs and SMEs in Malaysia.

Get updates on our latest articles

You May Also Like

You can download the “Islamic Finance and the Development of Malaysia’s Halal Economy” by World Bank Group here.

World Bank Group, sponsored by Bank Negara Malaysia and Securities Commission Malaysia, has recently published a report titled “Islamic Finance and the Development of Malaysia’s Halal Economy” to highlight the current state of the Halal Economy in Malaysia.

jomSETTLE are honored to be featured as one of the case studies for Fintech Digital Payment solution that are empowering the Halal MSMEs in Malaysia in managing their account payable and receivable via credit card.

It was a fine Monday morning (3rd October 2022) at Sasana Kijang Building, Bank Negara Malaysia in Kuala Lumpur where the launching event is being held. Aside from launching, the event was also to discuss strategies for boosting Malaysia’s economic growth through the competitiveness of the halal industry, which has a significant share of the global halal market.

Some of the images during the event.

The section about jomSETTLE in the Islamic Finance and the Development of Malaysia’s Halal Economy report, page 67.

About World Bank

The World Bank Group is a major source of funding and knowledge for developing countries around the world. Its five institutions are all dedicated to reducing poverty, increasing shared prosperity, and promoting long-term development.

More info: World Bank

Partnership to empower Malaysia Halal MSMEs

Since last year, we have worked closely with our partner Halal Integrated Platform (HIP) and Halal Development Corporation (HDC) to offer a better payment solution for the MSMEs.

Through jomSETTLE Make Payment, MSMEs can fund their business using their credit card by paying for any business expenses while conversing the cash in hand. This allows MSMEs to get short-term financing access via their credit card.

Alternatively, MSMEs can also use jomSETTLE Request Payment to allow their customers to pay them using credit card through a secured payment link. All are done in jomSETTLE cloud platform without the need of a credit card terminal, payment gateway, or website.

Our journey so far... and further we will go

To date, we have facilitated more than RM3 Million in business transactions for the Halal MSMEs through our platform in account payable and account receivables. (This number was based on jomSETTLE internal update on 30th September 2022. So, the number is different from the World Bank’s report)

With this, our team will continue to work toward a better payment solution for the MSMEs and SMEs in Malaysia.

Let's Stay in Touch

Get updates on our latest article.

You May Also Like

To create a better experience for you, we are upgrading our system, and as a result, the payment and acceptance services will be temporarily unavailable.