It has been 22 months since the first case of Covid-19 was reported in Wuhan. What followed was the step each country took to curb the virus by asking us to stay home. Malaysia was not slow to act, on 18 March 2020, Movement Control Order (MCO) was imposed Nationwide and 80% of the economic activities are put on hold.

Where this is the first experience for most of us business owners, we are lost…

During the lockdown, I recalled watching a video by Simon Sinek explaining that “These are not unprecedented times“. This has happened many times before where video stores is hit badly when streaming was first introduced and coffee shops were forced to close down with the founding of Starbuck.

Just that this time, instead of industries scale, it happens on a worldwide scale.

And it is not the pandemic that brought us down but our reluctance on innovating and poor cash flow management did. Innovating as in changing our business model from offline to online or to engage our customers in a non-traditional way.

Unfortunately, to innovate, you need to have good cash flow management because, without cash flow, you are simply focusing on surviving instead of innovating.

It was clear that many businesses in Malaysia lacked financial planning and struggled to cope with the unexpected downturn. To date, a total of 100,000 businesses closed down since the first Movement Control Order (MCO) was imposed.

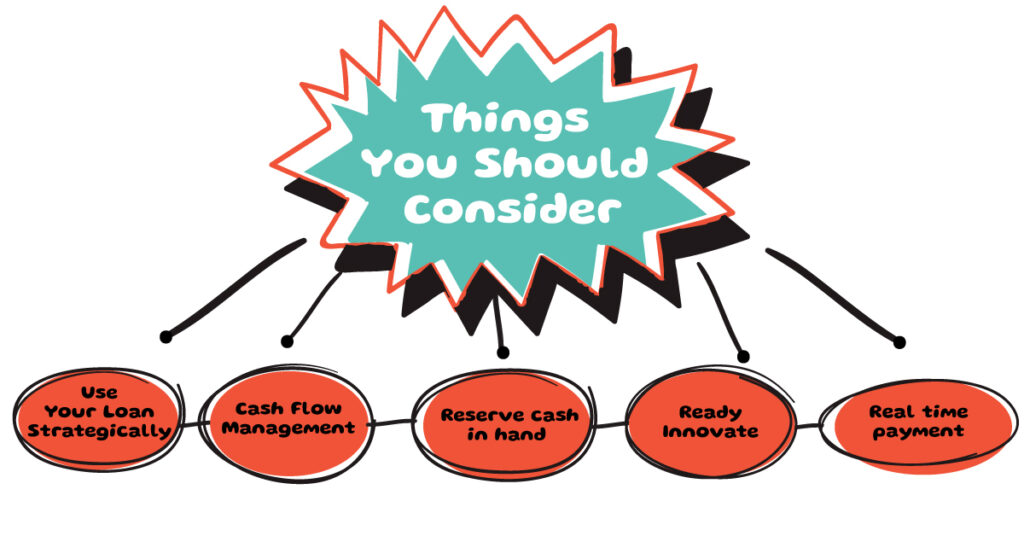

But like every other harsh lesson in the business world, we can always emerge stronger and more prepared for the next challenges. We have compiled a list of lessons learned from this pandemic.

Let’s drive into it now…

Cash Flow is the KEY

A healthy cash flow is always been the most important factor in managing a business. Ask any business owner and they will give you the same answer – YES!

With a healthy cash flow, your businesses will not easily crumble in face of another wave of challenges. Challenges can be as small as when your client payment is late and you need to settle your business expenses.

A company should have at least 6 months of available operating cash at all times. Operating cash is not just your business overhead but also includes what you are typically paying for marketing, sales, and administrative expenses too.

Let’s say you have a total operating cost of RM 30,000 per month, then your bank should have a total of RM 180,000 for you to be on the safe side.

Reserve cash in hand

Delaying the spending of your cash as long as possible certainly bring great value in term of managing cash flow. You will have more leeway to allocate your cash to places that can bring benefits to your company.

Don’t get me wrong, I’m not asking you to delay the payment to your supplier or staff.

I’m simply saying that in this case, you can consider using jomSETTLE Make Payment service. With jomSETTLE, you can pay your cash term only expenses using your credit card first. This way, you can hold on to your cash in hand longer by leveraging your credit card statement date.

You can learn more of our services here: jomsettle.com

Loans are never easy to get

Yes, in times of crisis, our government will step up to launch multiple initiatives to help us by providing us with a small amount of grants. But with so many to help and only so much to give, the Government hand are tied too.

Then we turn to our next resort, a business loan. At this stage, many of us are surprised by how hard and tedious is it to apply for a business loan. Not to mention all the documents for you to fill up, but the bank will need to access whether or not that your business model will be able to survive and repay them with the terms and interest stated.

Let’s say in any event that the bank accepted your business pitch, it will take them another 3-4 weeks to process your application and before you know it, you are already out of business.

Customers payment has to be real-time.. expand your payment acceptance methods beyond cash terms

There are two types of businesses, those that can accept any payment type they want without losing any customers; and then there are those that can only accept payment in cash terms because they feel like credit cards aren’t something that they can afford to accept.

If your businesses are the first one, then you are good. But if you are the latter one, then this pandemic has been far worst for you.

Let me give you a quick example.

When MCO happened, a lot of businesses scrumble to make an adjustment, not only operational wise but also financially wise.

Projects were put on hold by the client, a payment that was supposed to come in the day after got delayed indefinitely. Suddenly you are left with expenses to pay but no income coming in.

Then at this time, you contact your client asking for payment and they ask you this one question that got you stunned – “Can I pay you with my credit card?”

Are you gonna apply for a credit card receiving terminal now?

Yea you figured…. it is probably too late for that.

But with jomSETTLE Request Payment, you can start accepting credit card payment within 24 hours without going through a long and tedious application process and best of all is FREE! You can check our Request Payment services here: jomsettle.com/request-payment

Be Ready to Innovate

The video stores closed down due to streaming services is not because of their incompetence or their business model is simply not good. But is their willingness to innovate to adapt to the changing situation.

Doing businesses was never a competition but a game where we see who can survive the longest.

Like during this pandemic, we saw how gym trainer conduct their training via zoom, how restaurants started selling package products with the recipe, or even how to conduct an event virtually.

All these are not the will to win but to survive the crisis that we all faced.

Conclusion

These lessons can be hard to learn, and in some cases, even harder to implement. “Every cloud has a silver lining”. The pandemic is also a blessing in disguise. It is a wake-up call for all business owners. Things that happen in 2020 will serve as a lesson for all of us, and they will serve as a reminder and guide us to be alert and prepared to deal with future circumstances.

When the next downturn comes‚ and it will come someday‚ you’ll be thankful for doing this.

Get updates on our latest articles

You May Also Like

It has been 22 months since the first case of Covid-19 was reported in Wuhan. What followed was the step each country took to curb the virus by asking us to stay home. Malaysia was not slow to act, on 18 March 2020, Movement Control Order (MCO) was imposed Nationwide and 80% of the economic activities are put on hold.

Where this is the first experience for most of us business owners, we are lost…

During the lockdown, I recalled watching a video by Simon Sinek explaining that “These are not unprecedented times“. This has happened many times before where video stores is hit badly when streaming was first introduced and coffee shops were forced to close down with the founding of Starbuck.

Just that this time, instead of industries scale, it happens on a worldwide scale.

And it is not the pandemic that brought us down but our reluctance on innovating and poor cash flow management did. Innovating as in changing our business model from offline to online or to engage our customers in a non-traditional way.

Unfortunately, to innovate, you need to have good cash flow management because, without cash flow, you are simply focusing on surviving instead of innovating.

It was clear that many businesses in Malaysia lacked financial planning and struggled to cope with the unexpected downturn. To date, a total of 100,000 businesses closed down since the first Movement Control Order (MCO) was imposed.

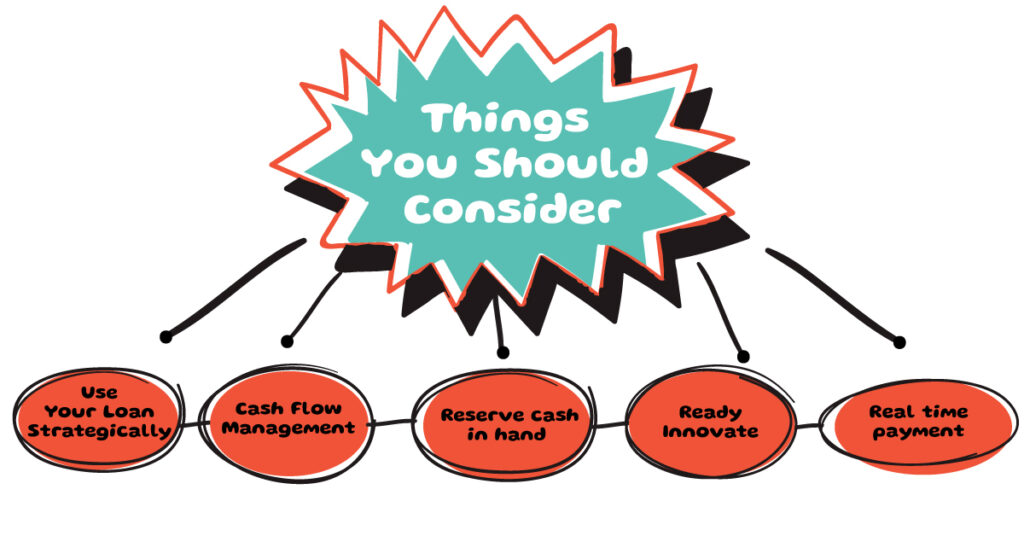

But like every other harsh lesson in the business world, we can always emerge stronger and more prepared for the next challenges. We have compiled a list of lessons learned from this pandemic.

Let’s drive into it now…

Cash Flow is the KEY

A healthy cash flow is always been the most important factor in managing a business. Ask any business owner and they will give you the same answer – YES!

With a healthy cash flow, your businesses will not easily crumble in face of another wave of challenges. Challenges can be as small as when your client payment is late and you need to settle your business expenses.

A company should have at least 6 months of available operating cash at all times. Operating cash is not just your business overhead but also includes what you are typically paying for marketing, sales, and administrative expenses too.

Let’s say you have a total operating cost of RM 30,000 per month, then your bank should have a total of RM 180,000 for you to be on the safe side.

Reserve cash in hand

Delaying the spending of your cash as long as possible certainly bring great value in term of managing cash flow. You will have more leeway to allocate your cash to places that can bring benefits to your company.

Don’t get me wrong, I’m not asking you to delay the payment to your supplier or staff.

I’m simply saying that in this case, you can consider using jomSETTLE Make Payment service. With jomSETTLE, you can pay your cash term only expenses using your credit card first. This way, you can hold on to your cash in hand longer by leveraging your credit card statement date.

You can learn more of our services here: jomsettle.com

Loans are never easy to get

Yes, in times of crisis, our government will step up to launch multiple initiatives to help us by providing us with a small amount of grants. But with so many to help and only so much to give, the Government hand are tied too.

Then we turn to our next resort, a business loan. At this stage, many of us are surprised by how hard and tedious is it to apply for a business loan. Not to mention all the documents for you to fill up, but the bank will need to access whether or not that your business model will be able to survive and repay them with the terms and interest stated.

Let’s say in any event that the bank accepted your business pitch, it will take them another 3-4 weeks to process your application and before you know it, you are already out of business.

Customers payment has to be real-time.. expand your payment acceptance methods beyond cash terms

There are two types of businesses, those that can accept any payment type they want without losing any customers; and then there are those that can only accept payment in cash terms because they feel like credit cards aren’t something that they can afford to accept.

If your businesses are the first ones, then you are good. But if you are the latter one, then this pandemic has been far worst for you.

Let me give you a quick example.

When MCO happened, a lot of businesses scrumble to make an adjustment, not only operational wise but also financially wise.

Projects were put on hold by the client, a payment that was supposed to come in the day after got delayed indefinitely. Suddenly you are left with expenses to pay but no income coming in.

Then at this time, you contact your client asking for payment and they ask you this one question that got you stunned – “Can I pay you with my credit card?”

Are you gonna apply for a credit card receiving terminal now?

Yea you figured…. it is probably too late for that.

But with jomSETTLE Request Payment, you can start accepting credit card payment within 24 hours without going through a long and tedious application process and best of all is FREE! You can check our Request Payment services here: jomsettle.com/request-payment

Be Ready to Innovate

The video stores closed down due to streaming services is not because of their incompetence or their business model is simply not good. But is their willingness to innovate to adapt to the changing situation.

Doing businesses was never a competition but a game where we see who can survive the longest.

Like during this pandemic, we saw how gym trainer conduct their training via zoom, how restaurants started selling package products with the recipe, or even how to conduct an event virtually.

All these are not the will to win but to survive the crisis that we all faced.

Conclusion

These lessons can be hard to learn, and in some cases, even harder to implement. “Every cloud has a silver lining”. The pandemic is also a blessing in disguise. It is a wake-up call for all business owners. Things that happen in 2020 will serve as a lesson for all of us, and they will serve as a reminder and guide us to be alert and prepared to deal with future circumstances.

When the next downturn comes‚ and it will come someday‚ you’ll be thankful for doing this.

Let's Stay in Touch

Get updates on our latest article.

You May Also Like

To create a better experience for you, we are upgrading our system, and as a result, the payment and acceptance services will be temporarily unavailable.