We have been doing a lot of copywriting in our ads regarding cash flow or the importance of reserving your cash in hand longer. So we thought why not write a blog about it to explain further why is cash flow so important to you – business owners.

What is Cash Flow?

Cash flow refers to the net amount of cash and cash equivalents flowing in and out of the company. Sometimes, you might see it only goes one way – out of the business.

Inflows

Outflows

Why Is Cash Flow Important?

Cash flow is considered the lifeline of a business. Without cash coming in, businesses can’t grow, hire, or even pay their expenses and they will easily crumble during any unexpected crisis.

Poor cash flow management or negative cash flow is one the biggest reasons SMEs fail. In a more layman term, it’s called “running out of money”, and it will shut you down faster than anything else.

But it is not their fault because managing a business’s cash flow is no easy task or some might say it is the most difficult part. You have many expenses such as rent, staff salaries, supplier invoices and other utility bills to be paid, money is going out fast. You may have pending payments from your clients but as long you have not received the payment, these are just considered as account receivables (money owed to you by your customers).

Most of the time, you can expect a delayed payment from your clients because they too are managing their cash flow in their own way. When this happened and you do not have a good amount of cash flow reserved in hand, you will find yourself with negative cash flow, or worst, you need to deal with a “cash crunch” situation.

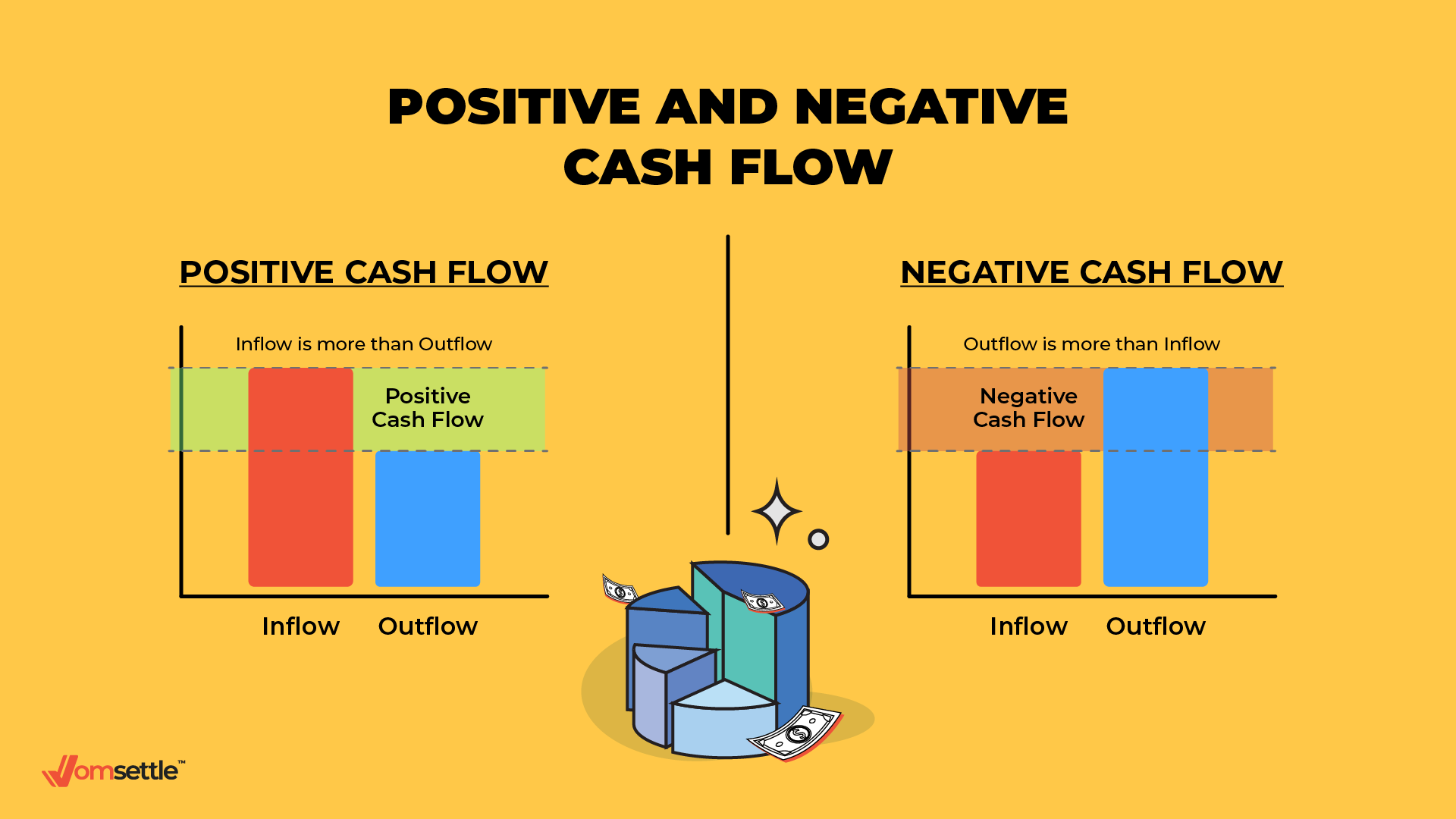

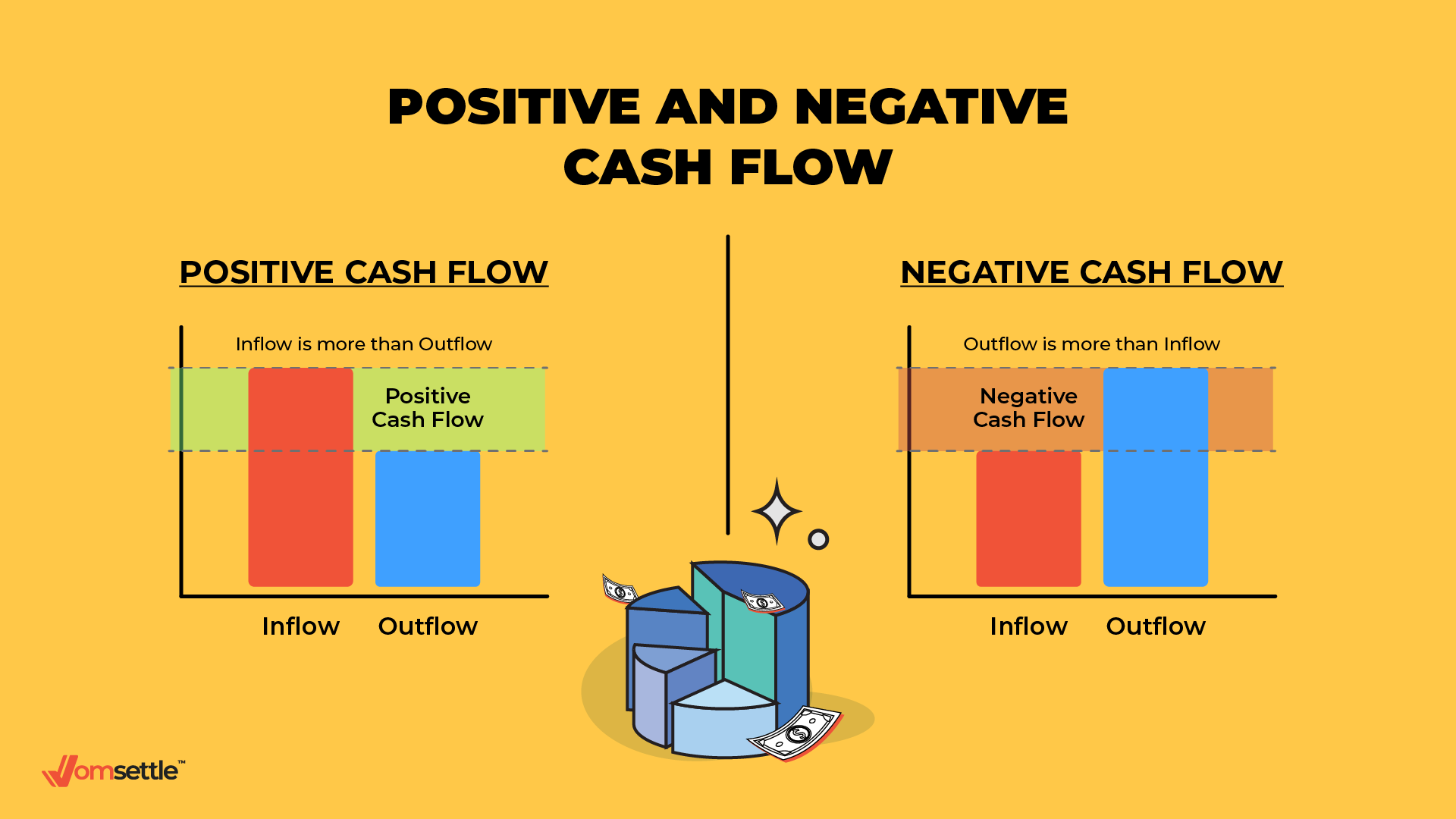

To avoid that, you simply need to have a positive cash flow by making sure that your inflow is always higher than your outflows. When your outflows are higher than your inflows, then you are in the negative cash flow. It sounds simple to do but believe us, even the most reputable companies are facing the same issues.

How Can jomSETTLE™ Helps You to Manages Your Cash Flow Better

Traditionally, to get out of a negative cash flow situation, businesses usually go for business financing. However, not every SMEs, especially start-ups are qualified for business financing.

This is where jomSETTLE™ can help you. jomSETTLE™ is an online payment processing platform that helps SMEs to maximize their working capital by tapping into their immediate credit available via credit card.

Pay Your Expenses with your credit card without using the cash in hand

Your credit cards come with a pre-approved line of credit that is typically underutilized, used only for smaller payments where the recipient accepts credit card payment. With jomSETTLE™ Make Payment, you will be able to make credit card payments for any large business expenses even when your recipient does not accept one.

To simplify it, you can buy stocks from your supplier, pay them using your corporate or personal credit card through jomSETTLE™, keep your cash in hand, make your profit and pay off your credit card 45 days later.

With the 45 extra days to float your cash, you need not worry about the late payment from your customers because now, your expenses are paid on time and your cash only leaves your bank account 45 days later.

Besides floating your cash for 45 days, you can also negotiate for an early payment discount that your vendors might offer. This can reduce your cost of goods purchase or the value of the discount can be used to offset the 2.5% transaction fee that jomSETTLE™ charges.

You can learn more about jomSETTLE™ Make Payment by clicking the button below.

Start to Offer Credit Card Payment Method to Your Customers

Like I mentioned earlier in this article, payments owed to you by your customers are just considered as account receivables. You are not the only one facing this issue, in fact, the majority of SMEs are having trouble collecting payments from their customers promptly.

This is because your customer wants to maintain a positive cash flow too. So they tend to delay the cash payment for as long as possible. jomSETTLE™ can help you to solve this too.

You can use jomSETTLE™ Request Payment to let your customers know that now they can pay you using their credit card. With this, you can receive your payment faster and your customer can enjoy the 45 days float when paying with their credit card. You can throw in a little bit of bait with your own early payment discount offer to encourage them to pay you earlier.

To use jomSETTLE™ Request Payment, you do not need to own a credit card terminal, website, or payment gateway. You just need to register your jomSETTLE™ account with no registration fee required and complete a simple verification process. Once your account is verified, you can start sending payment links to your customers.

You can learn more about jomSETTLE™ Request Payment by clicking the button below.

What You Can do with Your Cash Reserved?

Stay Afloat even during Financial Crisis

For starters, you can float the cash reserved and continue to operate in a healthy cash flow. An unexpected financial crisis will not crumble you easily, in fact, you might even emerge as a winner.

Increase your company revenue

You can use this cash to buy more stocks from your supplier too. Identify your hot seller products and invest more in them. With more stocks available and a good marketing strategy, you can boost your company sales.

Plan for Business Expansion

Always wanted to try something new for your business but cash flow has been a major obstruction? Now with the cash reserve, you can start trying out new things for your company. However, for this step, you do need to plan your strategies carefully.

Conclusion

Business owners are always in a vulnerable position. Often, you will find yourself in a cash crunch situation due to your account payables or account receivables and the traditional way was never a viable option for you.

So, we at jomSETTLE™ can help you to pay and float your cash or receive your payments earlier. Whatever your small business goals are, think of jomSETTLE™ as a partner that can help you to achieve those goals. Get started with jomSETTLE™. Sign up for your free account now!

Get updates on our latest articles

You May Also Like

We have been doing a lot of copywriting in our ads regarding cash flow or the importance of reserving your cash in hand longer. So we thought why not write a blog about it to explain further why is cash flow so important to you – business owners.

What is Cash Flow?

Cash flow refers to the net amount of cash and cash equivalents flowing in and out of the company. Sometimes, you might see it only goes one way – out of the business.

Inflows

Cash coming in from your customers who are buying your products or engaged in your services.

Outflows

Cash going out from your company in form of payments for expenses like rent or supplier invoices and other account payables.

Why Is Cash Flow Important?

Cash flow is considered the lifeline of a business. Without cash coming in, businesses can’t grow, hire, or even pay their expenses and they will easily crumble during any unexpected crisis.

Poor cash flow management or negative cash flow is one the biggest reasons SMEs fail. In a more layman term, it’s called “running out of money”, and it will shut you down faster than anything else.

But it is not their fault because managing a business’s cash flow is no easy task or some might say it is the most difficult part. You have many expenses such as rent, staff salaries, supplier invoices and other utility bills to be paid, money is going out fast. You may have pending payments from your clients but as long you have not received the payment, these are just considered as account receivables (money owed to you by your customers).

Most of the time, you can expect a delayed payment from your clients because they too are managing their cash flow in their own way. When this happened and you do not have a good amount of cash flow reserved in hand, you will find yourself with negative cash flow, or worst, you need to deal with a “cash crunch” situation.

To avoid that, you simply need to have a positive cash flow by making sure that your inflow is always higher than your outflows. When your outflows are higher than your inflows, then you are in the negative cash flow. It sounds simple to do but believe us, even the most reputable companies are facing the same issues.

How Can jomSETTLE Helps You to Manages Your Cash Flow Better

Traditionally, to get out of a negative cash flow situation, businesses usually go for business financing. However, not every SMEs, especially start-ups are qualified for business financing.

This is where jomSETTLE™ can help you. jomSETTLE™ is an online payment processing platform that helps SMEs to maximize their working capital by tapping into their immediate credit available via credit card.

Pay Your Expenses with your credit card without using the cash in hand

Your credit cards come with a pre-approved line of credit that is typically underutilized, used only for smaller payments where the recipient accepts credit card payment. With jomSETTLE™ Make Payment, you will be able to make credit card payments for any large business expenses even when your recipient does not accept one. To simplify it, you can buy stocks from your supplier, pay them using your corporate or personal credit card through jomSETTLE™, keep your cash in hand, make your profit and pay off your credit card 45 days later. With the 45 extra days to float your cash, you need not worry about the late payment from your customers because now, your expenses are paid on time and your cash only leaves your bank account 45 days later. Besides floating your cash for 45 days, you can also negotiate for an early payment discount that your vendors might offer. This can reduce your cost of goods purchase or the value of the discount can be used to offset the 2.5% transaction fee that jomSETTLE™ charges.

You can learn more about jomSETTLE™ Make Payment by clicking the button below.

Start to Offer Credit Card Payment Method to Your Customers

Like I mentioned earlier in this article, payments owed to you by your customers are just considered as account receivables. You are not the only one facing this issue, in fact, the majority of SMEs are having trouble collecting payments from their customers promptly. This is because your customer wants to maintain a positive cash flow too. So they tend to delay the cash payment for as long as possible. jomSETTLE™ can help you to solve this too. You can use jomSETTLE™ Request Payment to let your customers know that now they can pay you using their credit card. With this, you can receive your payment faster and your customer can enjoy the 45 days float when paying with their credit card. You can throw in a little bit of bait with your own early payment discount offer to encourage them to pay you earlier. To use jomSETTLE™ Request Payment, you do not need to own a credit card terminal, website, or payment gateway. You just need to register your jomSETTLE™ account with no registration fee required and complete a simple verification process. Once your account is verified, you can start sending payment links to your customers. You can learn more about jomSETTLE™ Request Payment by clicking the button below.

What You Can do with Your Cash Reserved?

Stay Afloat even during Financial Crisis

For starters, you can float the cash reserved and continue to operate in a healthy cash flow. An unexpected financial crisis will not crumble you easily, in fact, you might even emerge as a winner.

Increase your company revenue

You can use this cash to buy more stocks from your supplier too. Identify your hot seller products and invest more in them. With more stocks available and a good marketing strategy, you can boost your company sales.

Plan for Business Expansion

Always wanted to try something new for your business but cash flow has been a major obstruction? Now with the cash reserve, you can start trying out new things for your company. However, for this step, you do need to plan your strategies carefully.

Conclusion

Business owners are always in a vulnerable position. Often, you will find yourself in a cash crunch situation due to your account payables or account receivables and the traditional way was never a viable option for you.

So, we at jomSETTLE™ can help you to pay and float your cash or receive your payments earlier. Whatever your small business goals are, think of jomSETTLE™ as a partner that can help you to achieve those goals. Get started with jomSETTLE™. Sign up for your free account now!

Let's Stay in Touch

Get updates on our latest article.

You May Also Like

To create a better experience for you, we are upgrading our system, and as a result, the payment and acceptance services will be temporarily unavailable.