How do you feel when you are faced with a financial crisis? Do you break down feeling like something has tied you up in a gripping knot? Feeling restless, thinking of all the thousand ways you could get yourself out of it? But the main question arises; how do we cure this problem?

Being good in financial management does not mean you need to be great at math, but instead, it’s the good old portion of addition and subtraction (and a little pinch of good knowledge here and there).

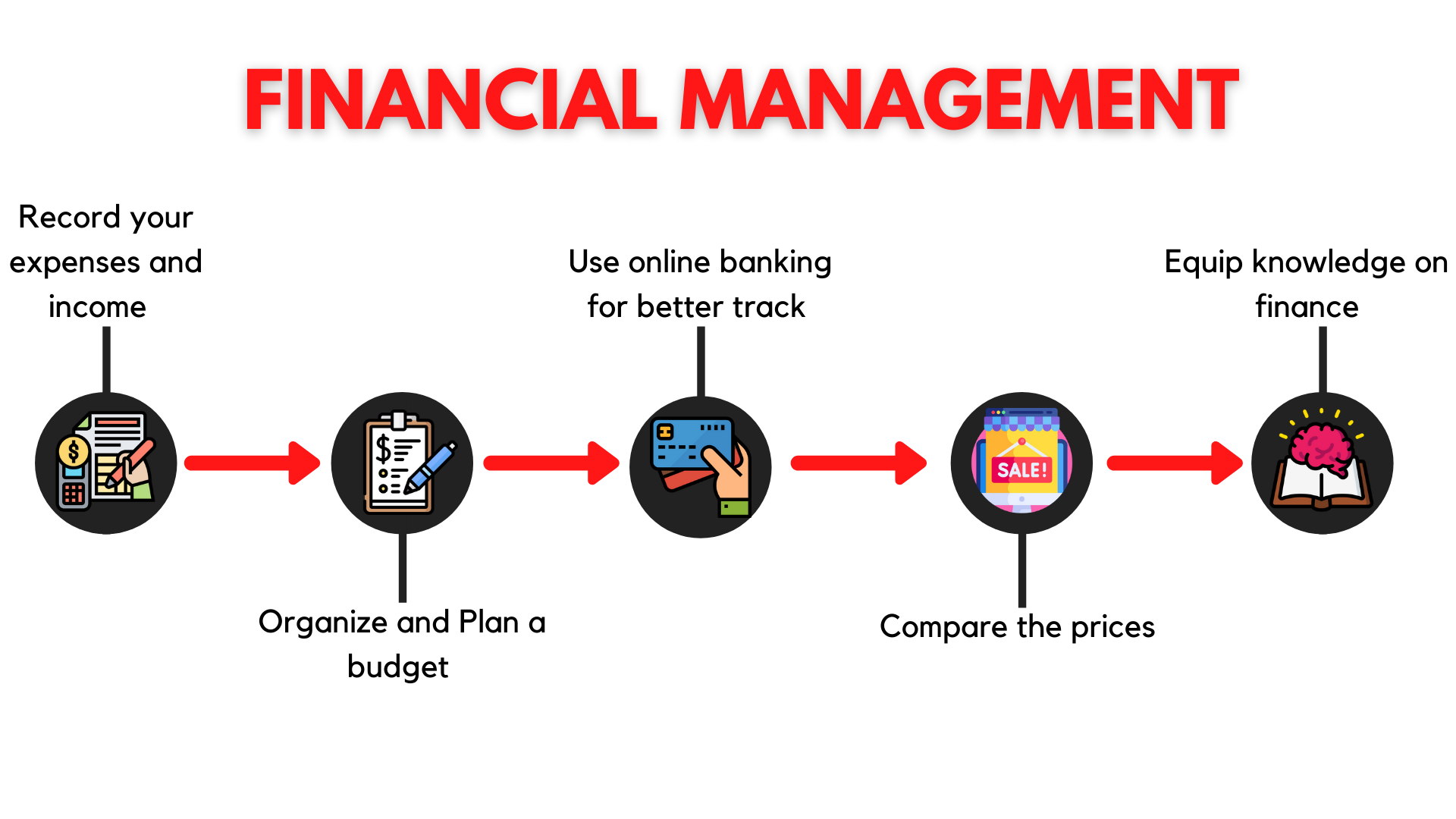

Here would be the five steps you can follow to take control of your power over financial management. With little effort and persistence nature, it’ll bring you peace of mind.

Sometimes we are not particular with what we spent. But it is important to record all of our expenses and income. There are many ways to record, be it in a spreadsheet, phone, mobile application, website or anything else. You record everything, even if it’s your biggest income, such as, your monthly paid to the smallest expenses of buying a loaf at the grocery. Having a sense of accountability would restrict you from over-spend or overdraw your money.

Imagine going on holiday with your family and coming home with no crisis in your finances. Heavenly, right? It’s more fun when you plan your financial management by creating a budget on your cash flow. This will ensure that would not face any sudden predicament that require a big flow of cash. You can start planning by figuring out your income for the month and adjust your cash flow. Say, for example, you save a portion of your monthly paid for emergency necessities, particularly for healthcare and any repairs needed. You can also save up for your entertainment necessities, where you can spend without worrying to eat a cup of instant noodles until the end of the month. Antoine de Saint-Exupery said, “A goal without a plan is just a wish”, so you can start planning now.

You need to ease up with the current trends of using digital payment as it is one of the most dynamic sectors in financial services today. Not only that it is less time consuming, the cashless environment would also bring a better transparency and security. Cash payment would be harder to trace, but for digital payment such as e-wallet and online banking, the digital footprint could be easily traceable as everything is tracked and stored efficiently. If you’re lucky enough, sometimes, using digital payment you can enjoy attractive discounts and freebies. Convenient, accessible and interactive, that’s the main purpose of using digital payment rather than literal cash.

This is what we call as, monitoring the price. Do not fall for the saying of “higher price equal to higher quality”. That is a marketing mantra. Sometimes you can get the same product, with the same quality with way more affordable price. Try to keep an eye on a good deal or discounts and do your research. Make sure that you are on top of your research and collect all pertinent pieces of information in regards to all the great deals happening around you.

With the speed of current technology, your fingertips are your saviour. Read, read and read! Talk to a financial master, or your family and discuss it with your spouse. There is practically an abundance of resources that you could use to organize your financial arrangement. Knowledge is money and power. Understanding the technicality behind the curtain of the financial industry would open your mind and eyes to make sense of the practicality of having good financial management. Devise your strategies according to your comfort and set your own goals and purpose by using the knowledge at hand. Take the time that you need to organize and in time, you’ll be your own financial master.

Visit our website jomSETTLE to find how your credit card can be useful in managing your financial expenses.

Get updates on our latest new

To create a better experience for you, we are upgrading our system, and as a result, the payment and acceptance services will be temporarily unavailable.