As part of a relief package, the government has reintroduced a six-month moratorium on all loans to individuals, including those from B40, M40, or T20 groups and micro, small, and medium businesses (SME). In line with the Pakej Perlindungan Rakyat dan Pemulihan Ekonomi (PEMULIH) announcement, borrowers affected by the pandemic may start applying for the moratorium starting from 7 July 2021 onwards, said Prime Minister Tan Sri Muhyiddin Yassin.

However, it is subject to the borrower’s credit records. Borrowers who missed their installments by more than 90 days or be subject to bankruptcy at the time of the request will not be applicable for the moratorium. To clear things out, borrowers who were previously under the repayment assistance program and those who complied with all the regulations set can opt-in for the moratorium.

Is there any difference for the 2021 Moratorium?

The purpose of a moratorium is to help with one’s monthly budget, particularly those who have been forced to go on unpaid leave or losses their job. Hence, there are no major changes compare to the previous program.

Is there any Compounded Interest or Penalty Charges for 2021 as the rumours said?

The government has announced that there will be no compounded interest or any penalty fee charge into the borrower’s moratorium. However, as BNM points out, interest continues to accrue during the moratorium period. So, while you may not have to pay anything right now, you will probably have to pay more in the long term because all collected interest over those six months will still be added to the total amount owed.

What are Compounded and Accrual Interests? How does it affect your loan repayment?

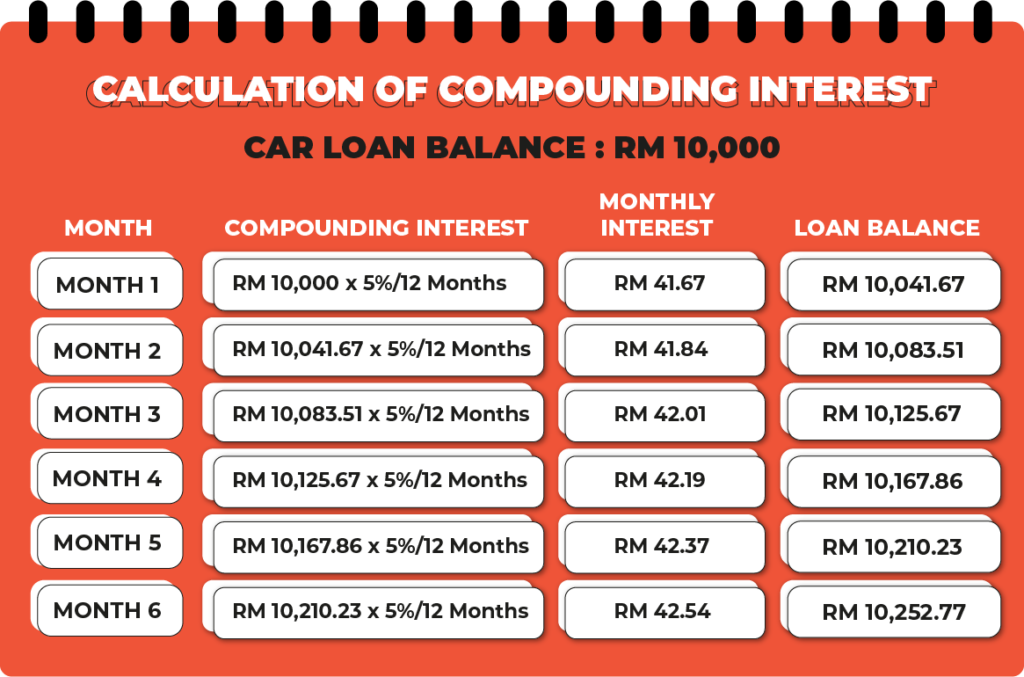

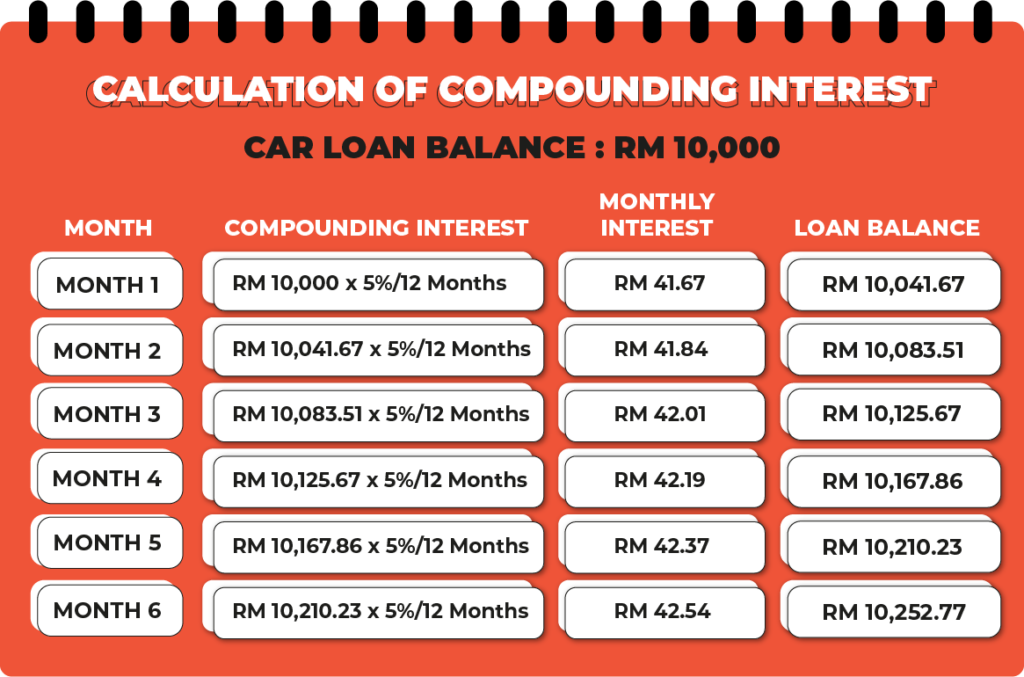

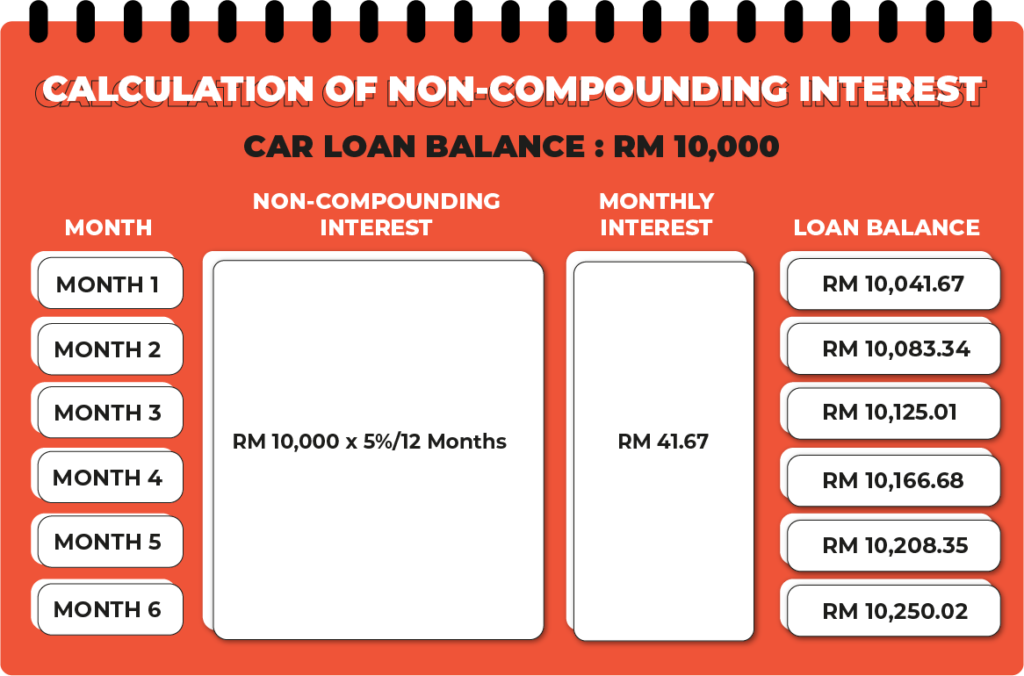

Compound interest is interest calculated on interest. For example, if interest is compounded during the loan moratorium, you will be charged interest on the principal plus interest on the accrued interest charges every month.

To help you understand better, take a look at the diagram:

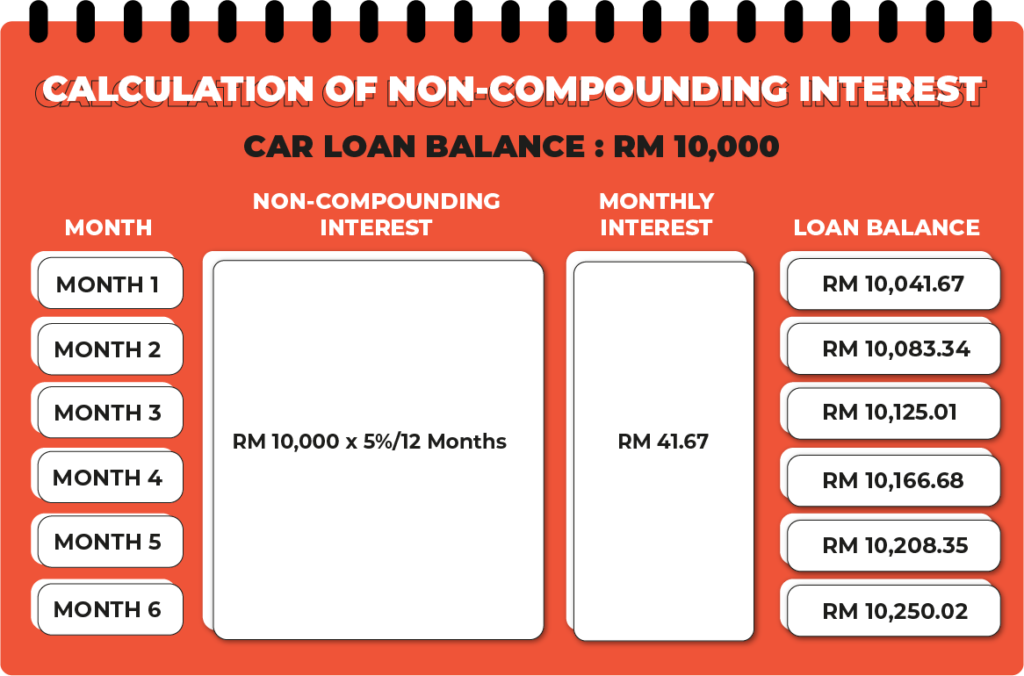

On the other side, accrued interest is simply the interest owed from the 6 months moratorium and yet unpaid. To clear this out, your 6 monthly interest will be carried forward as well as the principal amount. Now that the payments have been eliminated temporarily, the interest is simply added to the entire loan amount. However, you have several options to settle the accrued amount with your banks; you can either pay it in a lump sum or let it slide into your long-term monthly loan repayment.

Is there any difference for the 2021 Moratorium?

This time, the banks have explicitly stated that borrowers should examine the implications of requesting for an extended moratorium or Restructuring & Rescheduling because the short-term assistance may result in more charges to be paid later.

For borrowers, it means that you should carefully check the revised loan agreement for any additional interest or charges that may be included before signing them. Similarly, if you can afford to resume your loan commitments, it is a good idea to do so.

Sign up with us now!

Get updates on our latest articles

You May Also Like

As part of a relief package, the government has reintroduced a six-month moratorium on all loans to individuals, including those from B40, M40, or T20 groups and micro, small, and medium businesses (SME). In line with the Pakej Perlindungan Rakyat dan Pemulihan Ekonomi (PEMULIH) announcement, borrowers affected by the pandemic may start applying for the moratorium starting from 7 July 2021 onwards, said Prime Minister Tan Sri Muhyiddin Yassin.

However, it is subject to the borrower’s credit records. Borrowers who missed their installments by more than 90 days or be subject to bankruptcy at the time of the request will not be applicable for the moratorium. To clear things out, borrowers who previously under the repayment assistance program and those who comply with all the regulations set can opt-in for the moratorium.

Is there any difference for the 2021 Moratorium?

Is there any Compounded Interest or Penalty Charges for 2021 as the rumours said?

What are Compounded and Accrual Interests? How does it affect your loan repayment?

Compound interest is interest calculated on interest. For example, if interest is compounded during the loan moratorium, you will be charged interest on the principal plus interest on the accrued interest charges every month.

To help you understand better, take a look at the diagram:

On the other side, accrued interest is simply the interest owed from the 6 months moratorium and yet unpaid. To clear this out, your 6 months interest will be carried forward as well as the principal amount. Now that the payments have been eliminated temporarily, the interest is simply added to the entire loan amount. However, you have several options to settle the accrued amount with your banks; you can either pay it in lump sum or let it slide into your long-term monthly loan repayment.

Should you go for the Moratorium this time around?

This time, the banks have explicitly stated that borrowers should examine the implications of requesting for an extended moratorium or Restructuring & Rescheduling because the short-term assistance may result in more charges to be paid later.

For borrowers, it means that you should carefully check the revised loan agreement for any additional interest or charges that may be included before signing them. Similarly, if you can afford to resume your loan commitments, it is a good idea to do so.

Sign up with us now!

Let's Stay in Touch

Get updates on our latest article.

You May Also Like

To create a better experience for you, we are upgrading our system, and as a result, the payment and acceptance services will be temporarily unavailable.