Your credit card statement comes in every month just like your other bills but in a more confusing format. If you’ve ever looked at credit card statements, you know how difficult they can be to read. It’s filled with terms, numbers, percentages that play a role in the calculation of your total credit card balance and the list goes on…

Fortunately, you are not alone, in fact, many of us get confused with all these terms.

By the end of this article, we hope that we can help you to read and understand your credit card statement better and how you can leverage our services to your benefit.

What is a credit card statement?

A credit card statement is a detailed summary of how you used your credit card the previous month, the repayment that you need to make, the due date of your repayment to avoid any fees and charges.

Back in the day, your credit card statement usually comes to your mailbox but most of the bank has moved to e-statement now. You can download your statement through online banking or request for them to send it to your email inbox.

The meaning of credit card statement terms.

To know your statement first you must understand the terms.

Statement Date

The date on which your statement is generated and sent to you. Usually is the last day of your billing cycle and it covers all the transactions made for the previous cycle. Any transactions made after the statement date will reflect on your next billing statement.

Minimum Payment Due

The minimum amount that you are required to pay on or before the payment due date to avoid any payment late fee. (*Please note that interest charges on the outstanding amount are still applicable when you only pay your minimum amount)

Payment Due Date

The due date for you to settle your outstanding balance. Usually is 14-20 days from the statement date depends on your card issuers.

Combined Credit Limit

Total credit limit for all your credit card extended to you by your card issuers.

Previous Balance

Your outstanding balance from your previous statement.

Credit / Payment

Total payment that you made to repay your card.

Debit / Fees

Total amount that you spent through your card.

Retail Purchases

All transactions for the purchase of goods and/or services incurred using VISA/MASTERCARD for this statement cycle.

Pendahuluan Tunai

Amount of withdrawal of cash using your credit card.

Total Balance Due

Total amount payable that includes everything such as previous balance, new transactions, cash advance, and any fees or charges.

Transaction Date

Dates for all the transactions performed within this statement cycle.

Transaction Description

Details of all the transactions performed within this statement cycle.

Transaction Amount

Amount for all transactions performed within this statement cycle including fees and charges.

To start, you should always check your account numbers to make sure that it is the correct cards. Next is to look into your statement date and payment due date to avoid any late charges or interest fees.

The last few pages on your statement are usually your cashback or reward points earned together with some latest promotions from your bank.

Read here: what can you do with your credit card reward point

Now that you understand how your statement works, is time to use it to your benefit through jomSETTLE™

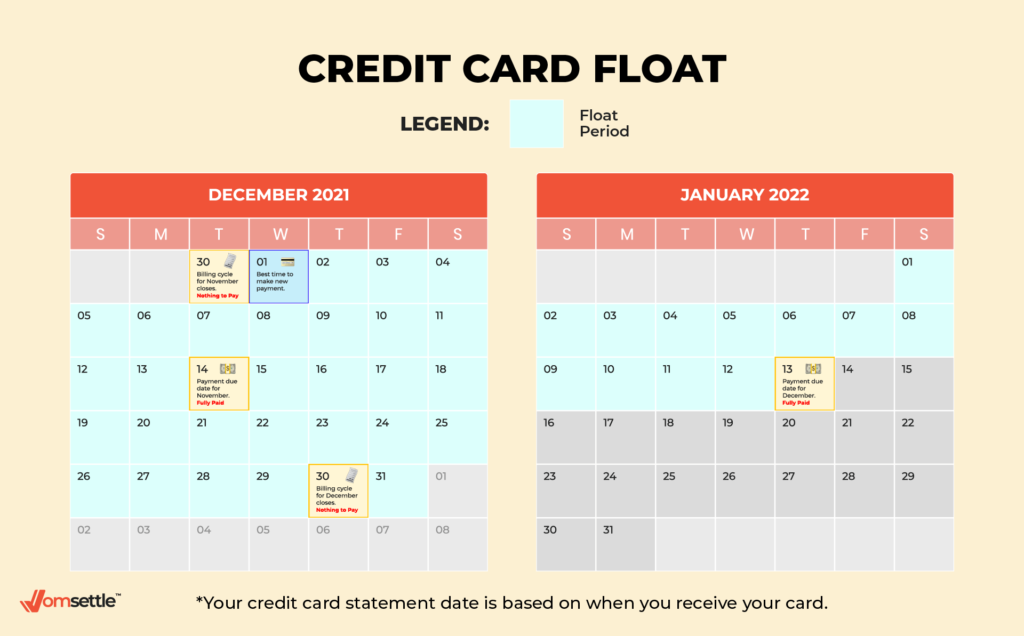

You now know that your credit card billing cycle is 30 days and there is a grace period of 14 days to settle your statement’s outstanding amount. Pay it off in full before the end of this grace period, and you pay 0% interest.

Meaning when you pay your business or personal necessity using your credit card through jomSETTLE™, you are reserving your cash for 44 days longer!

For a business, cash flow is essential to run your day-to-day operation smoothly. You might have a cash flow reserved for 27 days but what if your next payment is coming in 40 days later instead of the promised 20 days? By putting your cash term expenses into your credit card, you are basically buying yourself an additional 44 days times to float your cash. With this, you will have a cash flow reserved for 71 days.

As for the individual, having extra cash any day is a blessing because life is like a box of chocolate, we will never know what we get. An opportunity might appear or an emergency might occur. Thus, it is always beneficial for us to have extra cash in hand that we can immediately tap into.

Conclusion

Since we have been given free credit by the bank, we might as well leverage it for our benefits instead of spending on unnecessary stuff such as buying luxury goods which by the way are the main culprit for increasing our debts.

Register an account with jomSETTLE

Get updates on our latest articles

You May Also Like

Your credit card statement comes in every month just like your other bills but in a more confusing format. If you’ve ever looked at credit card statements, you know how difficult they can be to read. It’s filled with terms, numbers, percentages that play a role in the calculation of your total credit card balance and the list goes on…

Fortunately, you are not alone, in fact, many of us get confused with all these terms.

By the end of this article, we hope that we can help you to understand your credit card statement better and how you can leverage our services to your benefit.

What is a credit card statement?

A credit card statement is a detailed summary of how you used your credit card the previous month, the repayment that you need to make, the due date of your repayment to avoid any fees and charges.

Back in the day, your credit card statement usually comes to your mailbox but most of the bank has moved to e-statement now. You can download your statement through online banking or request for them to send it to your email inbox.

The meaning of credit card statement terms.

To know your statement first you must understand the terms.

Statement Date

The date on which your statement is generated and sent to you. Usually is the last day of your billing cycle and it covers all the transactions made for the previous cycle. Any transactions made after the statement date will reflect on your next billing statement.

Minimum Payment Due

The minimum amount that you are required to pay on or before the payment due date to avoid any payment late fee. (*Please note that interest charges on the outstanding amount are still applicable when you only pay your minimum amount)

Payment Due Date

The due date for you to settle your outstanding balance. Usually is 14-20 days from the statement date depends on your card issuers.

Combined Credit Limit

Total credit limit for all your credit card extended to you by your card issuers.

Previous Balance

Your outstanding balance from your previous statement.

Credit / Payment

Total payment that you made to repay your card.

Debit / Fees

Total amount that you spent through your card.

Retail Purchase

All transactions for the purchase of goods and/or services incurred using VISA/MASTERCARD for this statement cycle.

Pendahuluan Tunai

Amount of withdrawal of cash using your credit card.

Total Balance Due

Total amount payable that includes everything such as previous balance, new transactions, cash advance, and any fees or charges.

Transaction Date

Dates for all the transactions performed within this statement cycle.

Transaction Description

Details of all the transactions performed within this statement cycle.

Transaction Amount

Amount for all transactions performed within this statement cycle including fees and charges.

To start, you should always check your account numbers to make sure that it is the correct cards. Next is to look into your statement date and payment due date to avoid any late charges or interest fees.

The last few pages on your statement are usually your cashback or reward points earned together with some latest promotions from your bank.

Read here: what can you do with your credit card reward point

Now that you understand how your statement works, is time to use it to your benefit through jomSETTLE™

You now know that your credit card billing cycle is 30 days and there is a grace period of 14 days to settle your statement’s outstanding amount. Pay it off in full before the end of this grace period, and you pay 0% interest.

Meaning when you pay your business or personal necessity using your credit card through jomSETTLE™, you are reserving your cash for 44 days longer!

For a business, cash flow is essential to run your day-to-day operation smoothly. You might have a cash flow reserved for 27 days but what if your next payment is coming in 40 days later instead of the promised 20 days? By putting your cash term expenses into your credit card, you are basically buying yourself an additional 44 days times to float your cash. With this, you will have a cash flow reserved for 71 days.

As for the individual, having extra cash any day is a blessing because life is like a box of chocolate, we will never know what we get. An opportunity might appear or an emergency might occur. Thus, it is always beneficial for us to have extra cash in hand that we can immediately tap into.

Conclusion

Since we have been given free credit by the bank, we might as well leverage it for our benefits instead of spending on unnecessary stuff such as buying luxury goods which by the way are the main culprit for increasing our debts.

Register an account with jomSETTLE

Let's Stay in Touch

Get updates on our latest article.

You May Also Like

To create a better experience for you, we are upgrading our system, and as a result, the payment and acceptance services will be temporarily unavailable.