The announcement of the third Movement Control Order (MCO 3.0) did not come as a surprise but businesses are once again brought to a standstill, just when things are picking up. You as a business owner will have to start to prepared for the worse given all the economic sectors are still allowed to operate as usual.

There are many factors that you need to consider; the possibility of late payment from a client, drop in your monthly sales lead to stock lying unsold, payment due for your business expenses in the month-end, etc.

Facing unexpected cash flow issues due to the unprecedented economic downturn, you need to find resources that can help your business to stay afloat and prepare for what may be a years-long economic recovery.

For many years, in fact, since the existence of credit cards, it has been thought of as spending for luxury spending or even creating debt (I’m pretty sure you got that assumption too). But what if I tell you today that your credit card can be used to pay for your business expenses such as rent, staff salary, invoice, or any other of your overdue payment now?

With jomSETTLE™, all of the payments can now be made using your credit card. You can now pay for your business payment and hold on to your cash in hand longer for up to 30 days interest-free period. This way, you can pay for your expenses and still have more than enough cash to get through these unprecedented times.

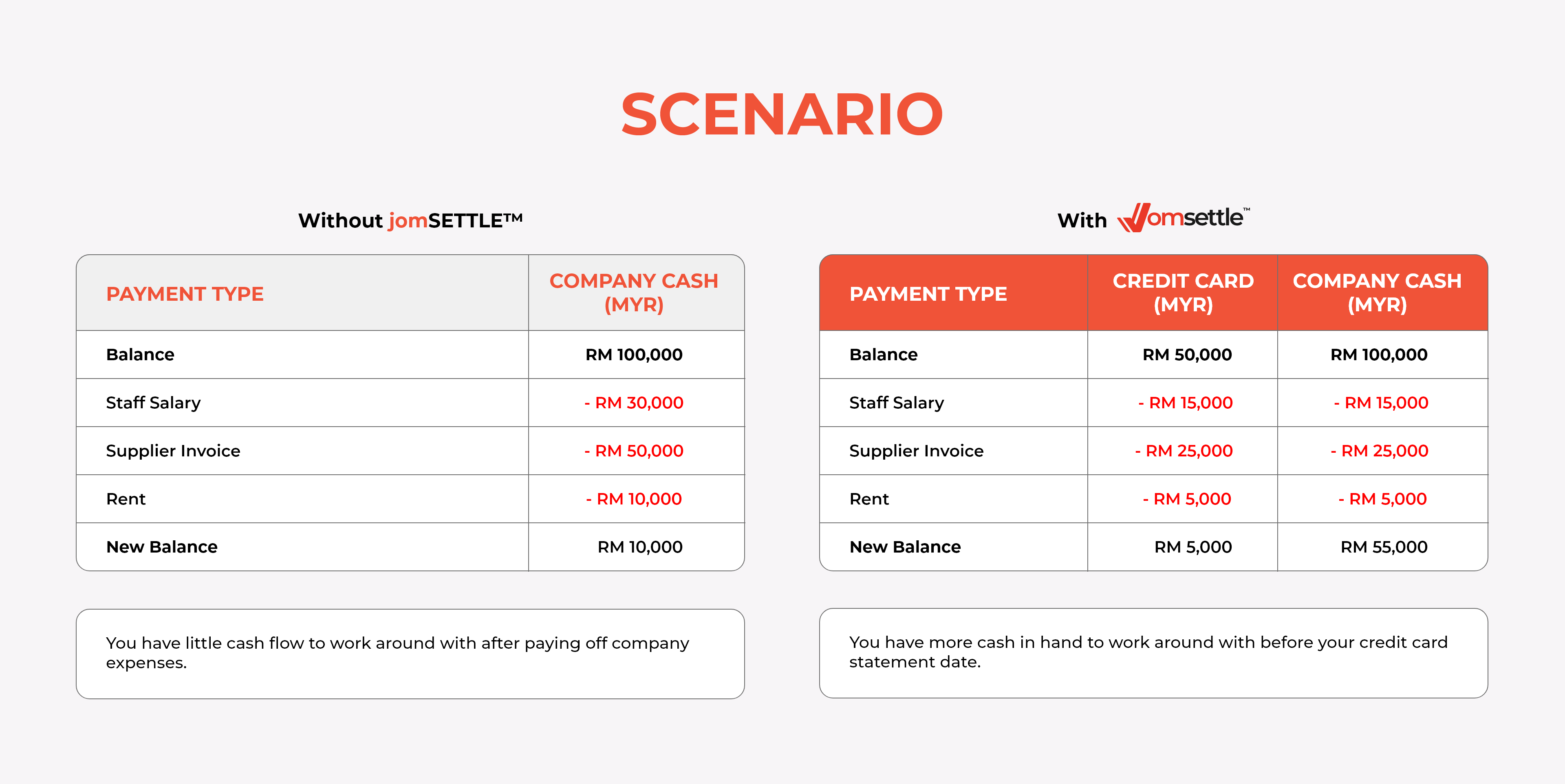

For further explanation on how you can use credit cards as a tool to reserve your cash, we have included a table as a reference:

For the past weeks, one of our clients has been paying a portion of his supplier invoices using his credit card through our platform. As a reseller like him, he now gets to pay his supplier virtually first but still getting the stock from them. With the stock in hand, he then sells to the merchant where they will pay him in cash that will be used to repay the credit card in full.

But what if we can leverage the usage for your situation by paying some of your monthly expenses first with your credit card. This helps you pay your business expenses on time and hold on to your cash in hand longer through this MCO 3.0. By doing so, you can work around with the cash reserved for emergency or other business-related matters.

If you were caught up on your payments, but struggling to make the minimums every week, contact your credit card issuer within 14 days of your usage and negotiate with them on restructuring your credit card repayment into installment with low interest.

Act now before your cash is gone!

Get updates on our latest new

To create a better experience for you, we are upgrading our system, and as a result, the payment and acceptance services will be temporarily unavailable.